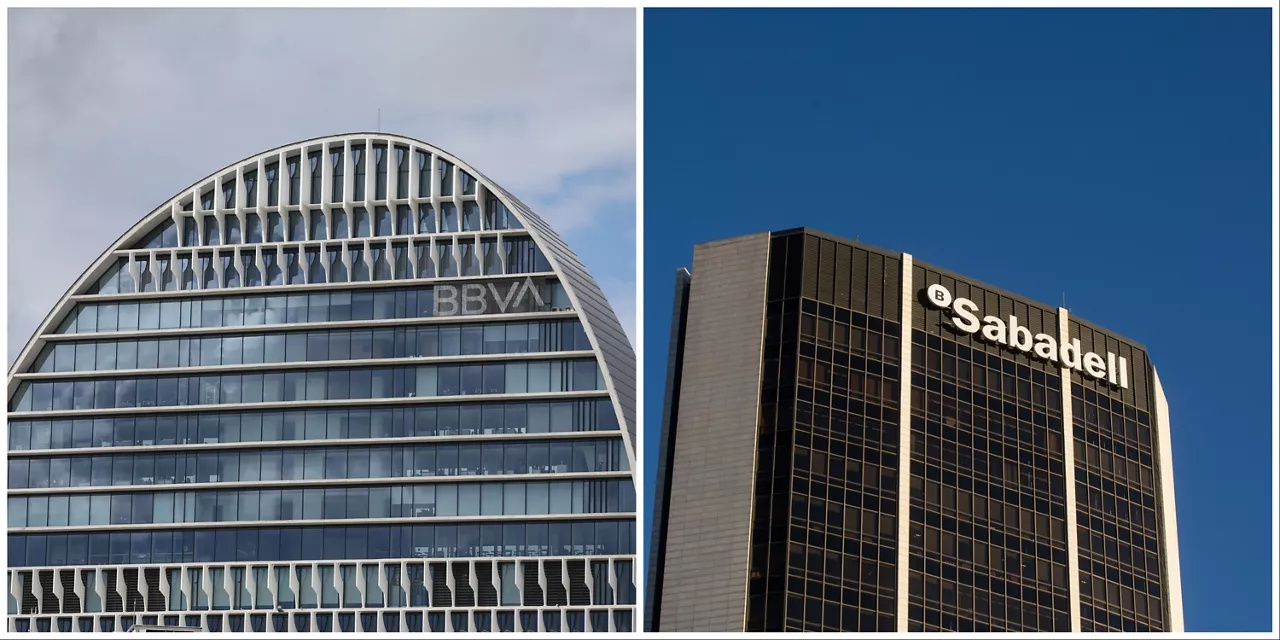

BBVA has improved its offer of access to Sabadell Bank by 10%

The president of the BBVA, Carlos Torres, has stressed that with this improvement they have made available to the shareholders of Banco Sabadell "an extraordinary offer, with historical valuation and price, and with the possibility of participating in the high value created with the union of the two banks".

The BBVA Board of Directorshas decided to improve the offer of Sabadell Bank and will offer ordinary shares of the new issue , an ordinary BBVA stock in Sabadell for every 4,8376 shares, an increase of 10%.

Previously, the bank offered a new BBVA stock and 70 cents in cash for every 5,5483 securities of the Catalan bank.

The BBVA has reported in a warning sent to the National Securities and Exchange Commission (CNMV) that, since the compensation offered will be in shares, shareholders with surplus-value will not be taxed if they accept more than 50% of Sabadell's voting rights, "as the transaction would be fiscally neutral."

At the end of Friday, the BBVA offered a new stock of the bank (16.41 euros) and 0.70 cents in cash, i.e. 17.11 euros and 5,5483 shares of Sabadell, valued at a total of 16.81 euros, which means that Sabadell's shareholder obtained a 1.8% premium for its shares.

Now, the entity chaired by Carlos Torres offers a bank share (16.41 euros) in Sabadell for 4,8376 shares (14.65 euros), a premium of 11.8%.

The president of the BBVA, Carlos Torres, has stressed that with this improvement they have made available to the shareholders of Banco Sabadell an "extraordinary offer, with historical valuation and price, and with the possibility of participating in the high value created with the union of the two banks".

"All of this means a significant increase in benefits for each of the actions planned in the future if they go to exchange, "he said.

The offer means that Sabadell's offer must be valued at EUR 3.39 per share, that is, at maximum levels of more than one tenth.

According to the bank, the value of the offer has improved by 60% since the day before the bank's interest became public on 29 April 2024, when it amounted to EUR 12.2002 billion, compared to EUR 19.5 billion today.

The entity also noted that the new offer would give Banco Sabadell shareholders a 15.3% stake in the BBVA.

In fact, he has specified that the merger will result in a profit per share (which determines the dividend per share), approximately 41% higher than the entity would if it were to move on its own.

"The premium offered at Banco Sabadell on the quotation value was very significant when the transaction was announced and much higher than that of other transactions similar to European banking, but has improved significantly following this increase in supply, "the BBVA adds.

Once the offer has been improved, the BBVA Board of Directors has decided to waive the possibility of further improvements, as well as to extend the deadline for approval.

BBVA has explained that the shareholders of Banco Sabadell, if they have gone to the exchange today, will benefit from the improved new terms of the offer.

The period of admission shall be suspended until the National Securities and Exchange Commission approves the Supplement to the Bid Improvement Brochure. Once approved, the period of admission shall be extended for the remaining days until the initial thirty days have been completed.

The BBVA will present its request for authorization to modify the offer today, together with the supplement to the explanatory leaflet, together with the report of an independent expert who certifies that the compensation has improved.

Until October 7th, the deadline for Sabadell shareholders to accept the BBVA purchase offer.

More news about the economy

2.8% of Sabadell customers with shares in the bank have accepted the BBVA offer

These shareholders represent 1.1% of the capital of Banco Sabadell. The Bank of Catalonia has explained that small shareholders who are customers own 30.8% of the capital.

The Basque Finance Council confirms the smooth running of tax collection and forecasts an increase of 5.2% by 2026

The forecast is to raise tax revenue to $21,130 million by 2026, a growth that will strengthen investment capacity in the Basque institutions, according to the Council.

Basque youth emancipate themselves almost 30 years after the European average

According to the latest study by the Basque Youth Observatory, women are emancipated almost a year earlier than men.

El Gobierno Vasco fija los servicios mínimos para la huelga general del 15 de octubre

La orden, firmada por el Departamento de Trabajo y publicada este miércoles, establece las prestaciones esenciales que deberán mantenerse en sectores clave como sanidad, transporte, educación, servicios sociales, energía o justicia.

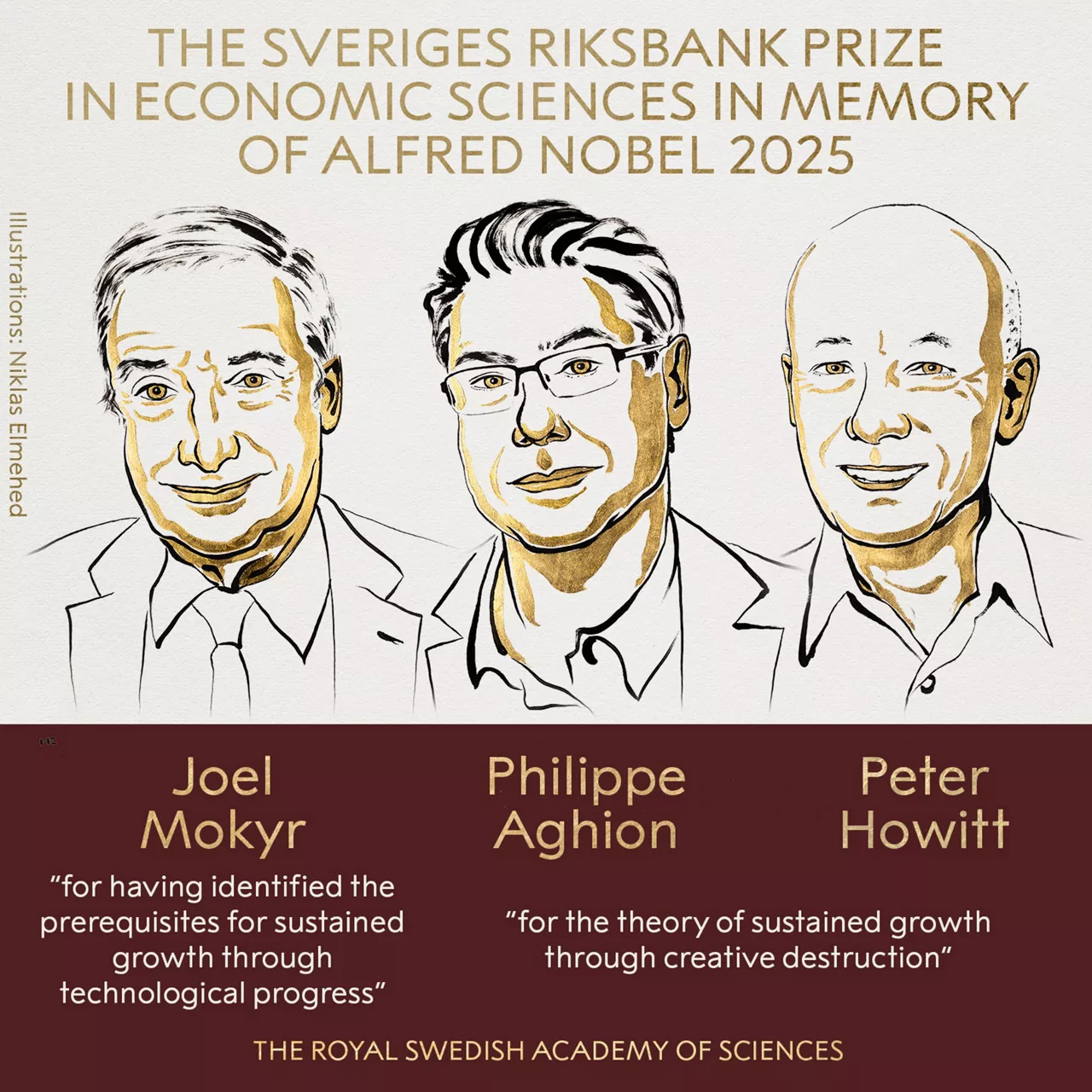

Joel Mokyr, Philippe Aghion eta Peter Howitt ekonomialariek irabazi dute 2025eko Ekonomiaren Nobel Saria

Suediako Zientzien Errege Akademiak hiru ekonomialari horiek saritu ditu "berrikuntzak bultzatutako hazkunde ekonomikoa azaltzeagatik".

The UPV Student Council has joined the general unemployment called for October 15 in support of Palestine

In a statement, the Student Council has explained that the call for an academic stoppage has been aimed at facilitating the cessation of violence and participation in demonstrations calling for the protection of the human rights of the Palestinian people.

The National Securities and Exchange Commission will publish the outcome of the BBVA offer on Friday

One of the consequences may be that the BBVA is forced to make a Sabadell Public Purchase Offer (PPE).

The workers of the Villaves have supported the continuation of the strike in a very tight vote

The strike has been supported by 50.6% of public transport workers, that is, this option has been imposed by a difference of six votes. The TCC company has warned that it will not negotiate until unemployment is suspended.

Mondragon Corporation's Diknua cooperative has paid $1.5 million for Newfoundland and will retain 56 jobs

The Commercial Court No. 1 of Donostia-San Sebastián has authorized the operation which will involve maintaining the 56 jobs of the company in the Basque Country, "respecting working conditions and seniority".

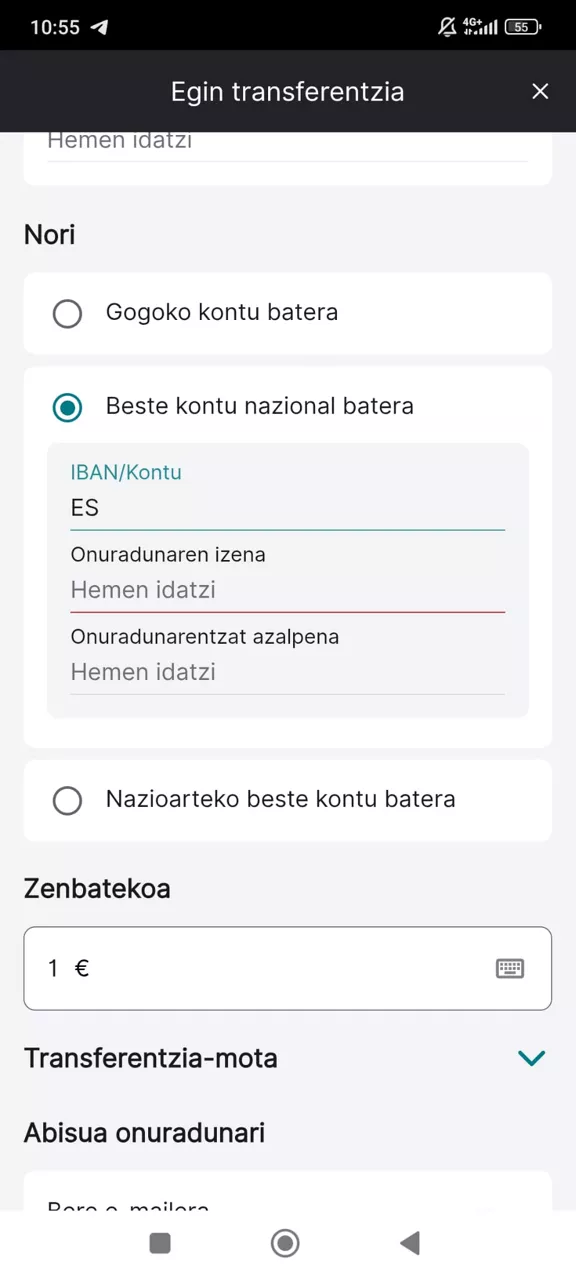

That's the new online fraud banking check

From now on, the bank will notify the user if the recipient's name and IBAN code do not match, as this measure is intended to nip in the bud the transfer fraud.