The National Securities and Exchange Commission will publish the outcome of the BBVA offer on Friday

One of the consequences may be that the BBVA is forced to make a Sabadell Public Purchase Offer (PPE).

Shareholders of BBVA, Banco Sabadell and both entities are awaiting the results of the Public Purchase Offer (OPE), which ended last Friday and whose final approval data will not be known until 17 October, as advanced by the National Securities and Exchange Commission (CNMV).

In view of the "contradictory information" on the next milestones of the BBVA PIE, the supervisor was obliged to provide this clarification. The decisions resulting from the outcome of the offer will be notifiedto the market on the same day 17 , following the above-mentioned publication.

One of the possible consequences of the outcome of the PIE may be the obligation of the BBVA to make a Sabadell Public Purchase Offer, in accordance with the Royal Decree regulating such offers.

In particular, if the BBVA reaches 30% of the control, but does not reach 50% of the approval, it may waive the minimum threshold of approval and remain within that margin. However, this would force him to set in motion a second OPEC, in exchange for the capital he does not have in Sabadell, and at a fair price.

In such a case, the National Securities and Exchange Commission shall communicate the criteria for determining the fair price below which the price set by the bidder may not be placed.

In the last few days there has been a dance of figures about the possible approval of the PIE. In an interview with Europa Press last Wednesday, BBVA President Carlos Torres was convinced that it would exceed 50% and could reach up to 60%.

For its part, Banco Sabadell believes that approval is difficult to reach the minimum quota. "It is very difficult to reach 30%, and if they reach 30% it will be fair. The logical thing is for the board itself not to move forward because it is putting the BBVA itself at risk, "Banco Sabadell CEO César Gonzalez-Bueno said in another interview with Europa Press on Tuesday.

More news about the economy

2.8% of Sabadell customers with shares in the bank have accepted the BBVA offer

These shareholders represent 1.1% of the capital of Banco Sabadell. The Bank of Catalonia has explained that small shareholders who are customers own 30.8% of the capital.

The Basque Finance Council confirms the smooth running of tax collection and forecasts an increase of 5.2% by 2026

The forecast is to raise tax revenue to $21,130 million by 2026, a growth that will strengthen investment capacity in the Basque institutions, according to the Council.

Basque youth emancipate themselves almost 30 years after the European average

According to the latest study by the Basque Youth Observatory, women are emancipated almost a year earlier than men.

El Gobierno Vasco fija los servicios mínimos para la huelga general del 15 de octubre

La orden, firmada por el Departamento de Trabajo y publicada este miércoles, establece las prestaciones esenciales que deberán mantenerse en sectores clave como sanidad, transporte, educación, servicios sociales, energía o justicia.

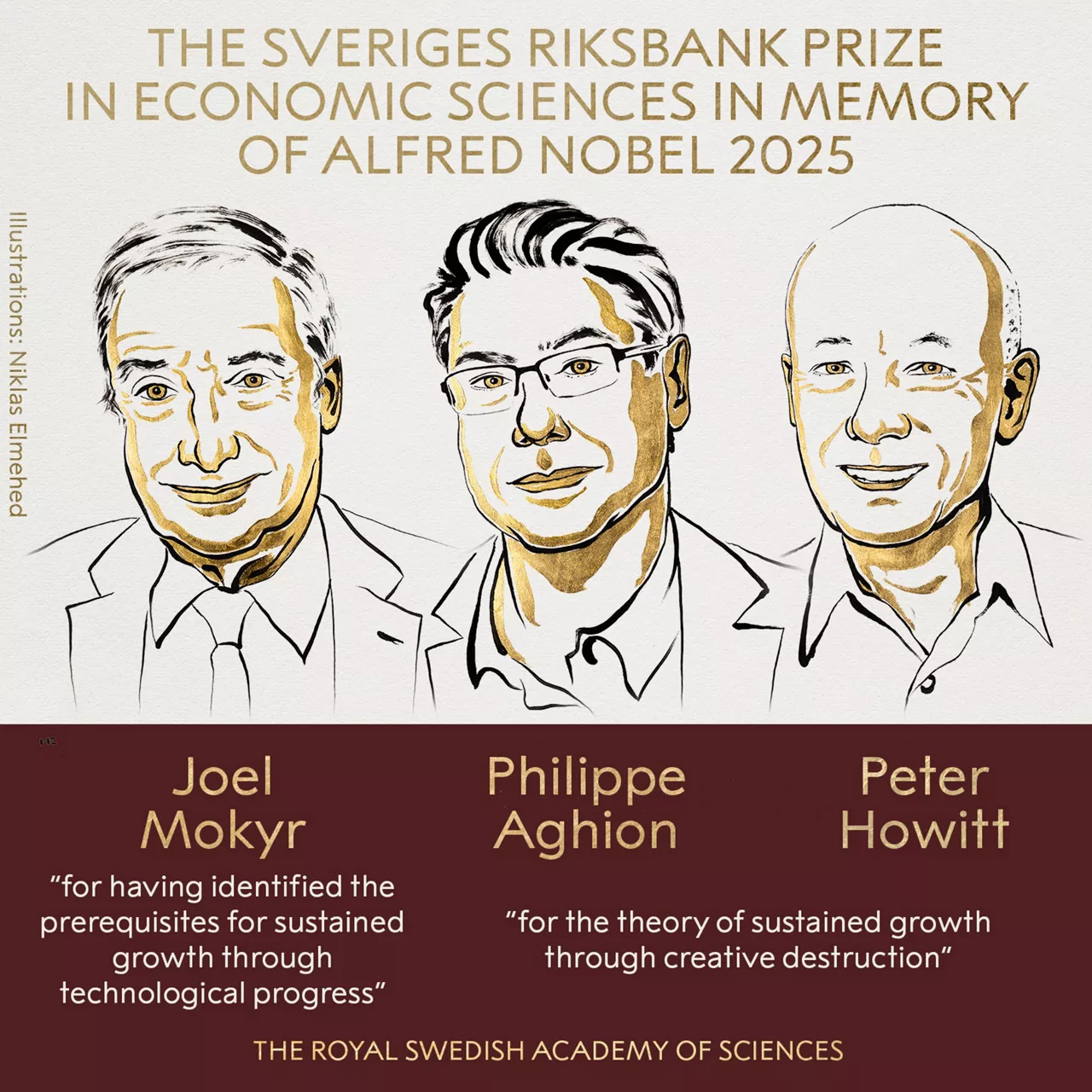

Joel Mokyr, Philippe Aghion eta Peter Howitt ekonomialariek irabazi dute 2025eko Ekonomiaren Nobel Saria

Suediako Zientzien Errege Akademiak hiru ekonomialari horiek saritu ditu "berrikuntzak bultzatutako hazkunde ekonomikoa azaltzeagatik".

The UPV Student Council has joined the general unemployment called for October 15 in support of Palestine

In a statement, the Student Council has explained that the call for an academic stoppage has been aimed at facilitating the cessation of violence and participation in demonstrations calling for the protection of the human rights of the Palestinian people.

The workers of the Villaves have supported the continuation of the strike in a very tight vote

The strike has been supported by 50.6% of public transport workers, that is, this option has been imposed by a difference of six votes. The TCC company has warned that it will not negotiate until unemployment is suspended.

Mondragon Corporation's Diknua cooperative has paid $1.5 million for Newfoundland and will retain 56 jobs

The Commercial Court No. 1 of Donostia-San Sebastián has authorized the operation which will involve maintaining the 56 jobs of the company in the Basque Country, "respecting working conditions and seniority".

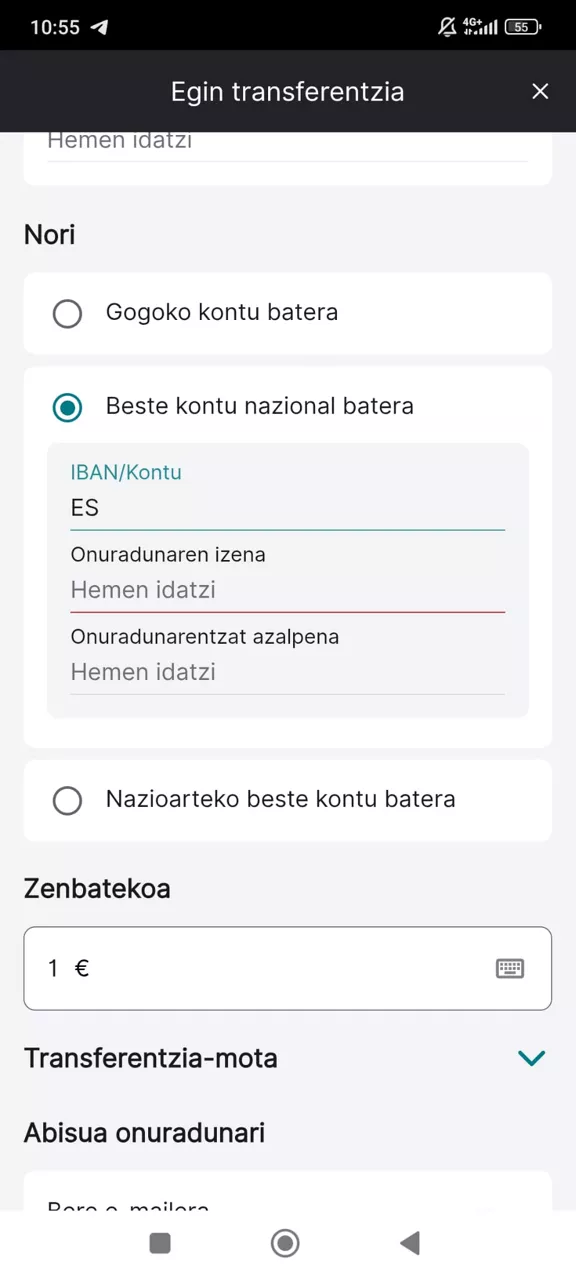

That's the new online fraud banking check

From now on, the bank will notify the user if the recipient's name and IBAN code do not match, as this measure is intended to nip in the bud the transfer fraud.