BBVA has earned 5,447 million euros until June, 9.1% more, thanks to its business in Spain and Mexico

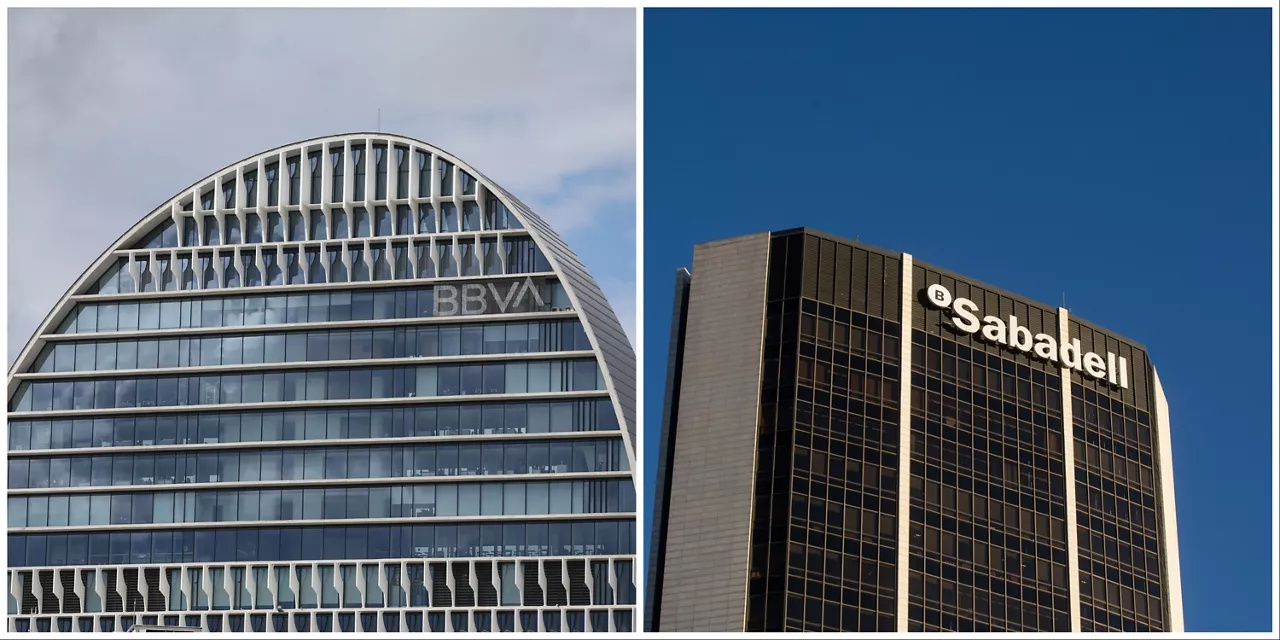

In addition to exceeding market expectations, the Entity has improved its forecasts for the coming years, with the countdown to opening the subscription to the Sabadell public purchase offer in full.

BBVA has broken its profit level of € 5,447 million in the first half of 2025, 9.1% morethan in the same period of 2024, thanks to strong activity in Spain and Mexico. The bank has exceeded analysts "expectations and improved its prospects for the future: it expects a cumulative profit of €48 billion between 2025 and 2028, of which €36 billion will be for shareholders.

As far as operations are concerned, recurring revenue grew by 12 per cent (without currency impact), reaching 16,617 million , and customer credit increased by 3.4 per cent , particularly for companies. It reached 5.7 million new customers and provided financing for both small and medium-sized enterprises and self-employed and large enterprises.

The financial indicators were also strong: RoTE 20.4%, ROE 19.5%, tangible stock value plus dividends of €10.13, and CET1 13.34% above ECB conditions. The bank also maintains a 2.9% default rate and 81% coverage.

By region, Spain (2,144 million, 21% more), Mexico (2,578 million, 6% more), Turkey (412 million, 17% more) and South America (421 million, 33% more) stand out.

The CEO, Onur Genç, has stated that the BBVA is at its best in its history.

More news about the economy

Serveo workers have gathered in Basauri against an ERE affecting 22 workers

Called by CCOO, Serveo workers have denounced "invisible redundancies in Bridgestone" and called an indefinite strike starting next Monday.

The BBVA has appealed to the Supreme Court the condition of the Spanish Government to accept the public offer to buy Banco Sabadell

The Bank filed the appeal on 15 July, three weeks after the Spanish Government announced the condition. In particular, the Sánchez Government obliges the two entities to maintain separate legal identity and assets over the three years.

Tax collection in the Basque Country has increased by 10.8% in the first half of 2025

The three Basque treasuries collected 11,173.7 million euros until July, an increase of 10.8% over the same period last year and 1,092.9 million more.

The Basque Government denies environmental authorization to wind farms El Haya 1 and 2 in Balmaseda

Side Recovery Systems wants to install four wind turbines in the Kolitza area, but, according to the report, the area is protected by the alimoche.

CPI in the Basque Country fell by a tenth in July and rose 0.2% in Navarre

In year-on-year terms, inflation is 3 per cent in the Basque Country and 2.7 per cent in Navarre, the same as in the State average.

Statkraft has criticized the negative environmental impact statement of the projected wind farm

The wind farm was planned in the Guipuzcoan municipalities of Azpeitia, Zestoa and Errezil and has received an adverse environmental resolution. The company considers that the wind farm "was designed to promote the socialization of energy, seeking the involvement of companies, administrations and local communities".

The government has denied environmental authorization to the Piaspe wind project

The Department of Industry, Energy Transition and Sustainability of the Basque Government has rejected the project of the wind farm planned by the company Statkraft between Azpeitia, Zestoa and Errezil. The report concludes that the mills and energy infrastructures that were to be built in the area of the mountain would cause environmental damage.

BBVA maintains its offer and continues its efforts to buy Sabadell

The decision to maintain the purchase offer by the company chaired by Carlos Torres comes a week after Sabadell shareholders almost unanimously agreed to sell its British subsidiary TSB to Santander Bank.

Strike at the Bilbao Municipal Police switchboard during Big Week

ELA denounces that the City Council and the Lanalde subcontract do not want to negotiate an improvement in the working conditions of the five professionals who make up the service.

The government approves the construction of two solar parks in Álava, one in Salvatierra and one in Respaldo

The Official Gazette of the Basque Country published on Thursday that both projects have obtained environmental authorisation. The facilities will have an area of 32 hectares and a power of 20 megawatts.