Iberdrola has earned 5,307 million euros until September, 3% less than last year for previous surplus-value

In the first nine months of the year, investment has increased by 4%, to 8,964 million euros, of which more than 60% have been made in the United Kingdom and the United States, 55% of which have been earmarked for the network business. Iberdrola will propose a "record" dividend of at least 0.25 euros per share, 8.2% more than in the first nine months of 2024.

Iberdrola has made a net profit of 5,307 million euros until September, 3% less than in the same period of 2024, when it accounted for surpluses for divestment of part of its assets in Mexico and was waiting to complete the sale of the rest announced at the end of last July.

Accordingto the results released this Tuesday to the National Securities andExchange Commission, the company has recorded gross profits of 12,438 million, 6.3% less than in the same period a year ago, and revenue of 33,863 million, 2.3% more.

The company has explained that if the surplus-value for divestment of thermal generation assets in the first quarter of 2024 and the contribution for the sale of smart meters in the United Kingdom in the third quarter of 2025 is dispensed with, and the impact of "capital allowance" in the United Kingdom is adjusted, the adjusted net profit has increased by 16.6%, while the adjusted ebitda has increased by 4.4%.

Asfar as investments areconcerned, they have increased by 4% in the first nine months of the year, to EUR 8,964 million, of which more than 60% have been made in the United Kingdom and the United States, and 55% have been allocated to the network business.

Thus, the company has allocated EUR 4.904 billion to network investments, an increase of 12% over the first nine months of the year compared to the same period last year, which has allowed the base of electricity networks to reach EUR 49.3 billion, 12% more than in the same period of the previous year.

In addition, the company has invested EUR 3.442 billion in creation and customers.

On the other hand, the company has reported that it has reduced its net debt by EUR 3.2 billion, to around EUR 48 billion, thanks to its policy of rotation of assets and alliances.

The company has stated in a statement that it already has more than EUR 160 billion in assets and a capitalization of around EUR 115 billion, which places it as the first European utility and is one of the two largest in the world in terms of stock market value.

(We're working to complete the information.)

More news about the economy

Garrido: "There will be continuous budgets, and if policies don't change, the results will be the same."

The PP spokeswoman in the Basque Parliament, Laura Garrido, has explained that the 2026 draft budget approved this Tuesday will be 'continuous' and 'ineffective'. 'The problems we have on the table are the problems we had at the beginning of the legislature: housing, safety or health.

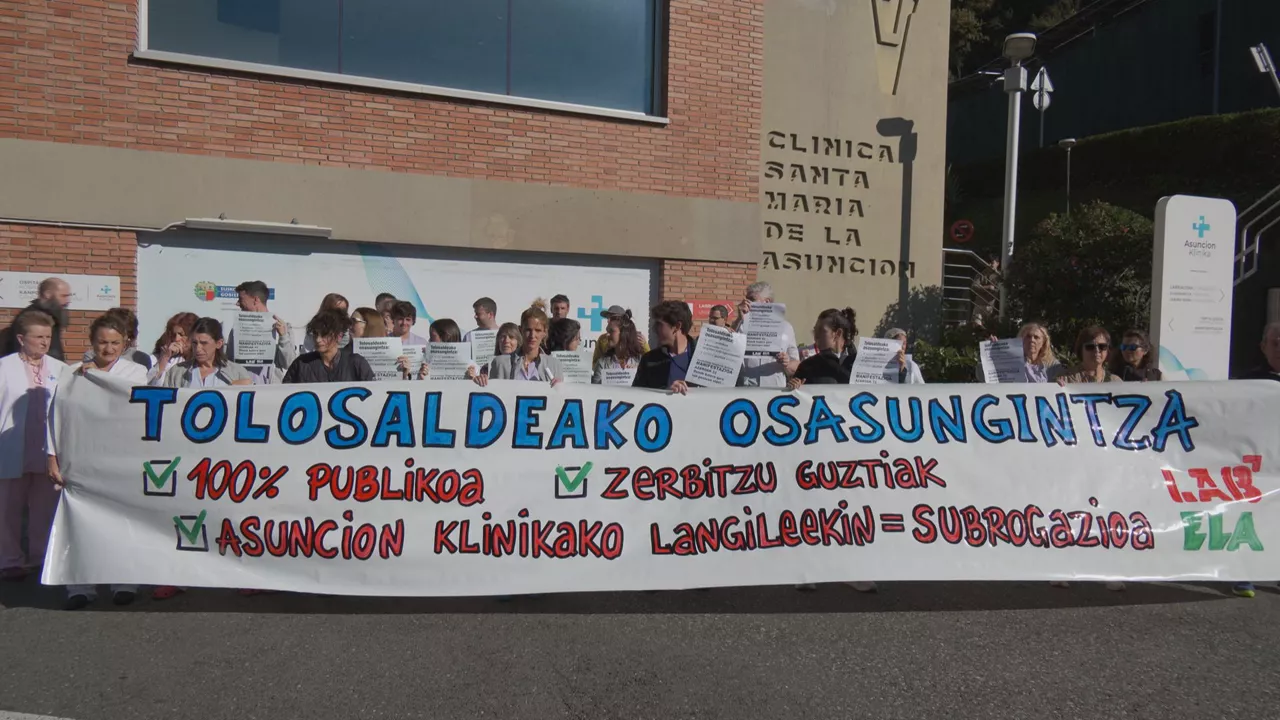

The workers at the Asunción Clinic in Toulouse are asking for subrogation in a hospital that will be "100% public"

They have asked the Health Counselor to follow the example they have used in Onkologikoa and subrogate the 350 employees of the clinic, who will demonstrate in Toulouse on 22 November.

The Basque Government defends Operation Talgo despite open investigation into Jainaga

The Basque Government has defended the process of buying part of Talgo's shares, despite the fact that the National High Court has opened an investigation into President José Antonio Jainaga because, in its view, they are "two different things."

The Itsaraz wind farm project "did not meet the necessary environmental conditions," according to Asensio

The final decision of the Spanish Government to reject once and for all the project that the Norwegian company Statkraft planned to build in Aramaio and Eskoriatza is "in line" with the criterion of the Basque Government, according to the Deputy General and Deputy of Sustainability of Gipuzkoa .

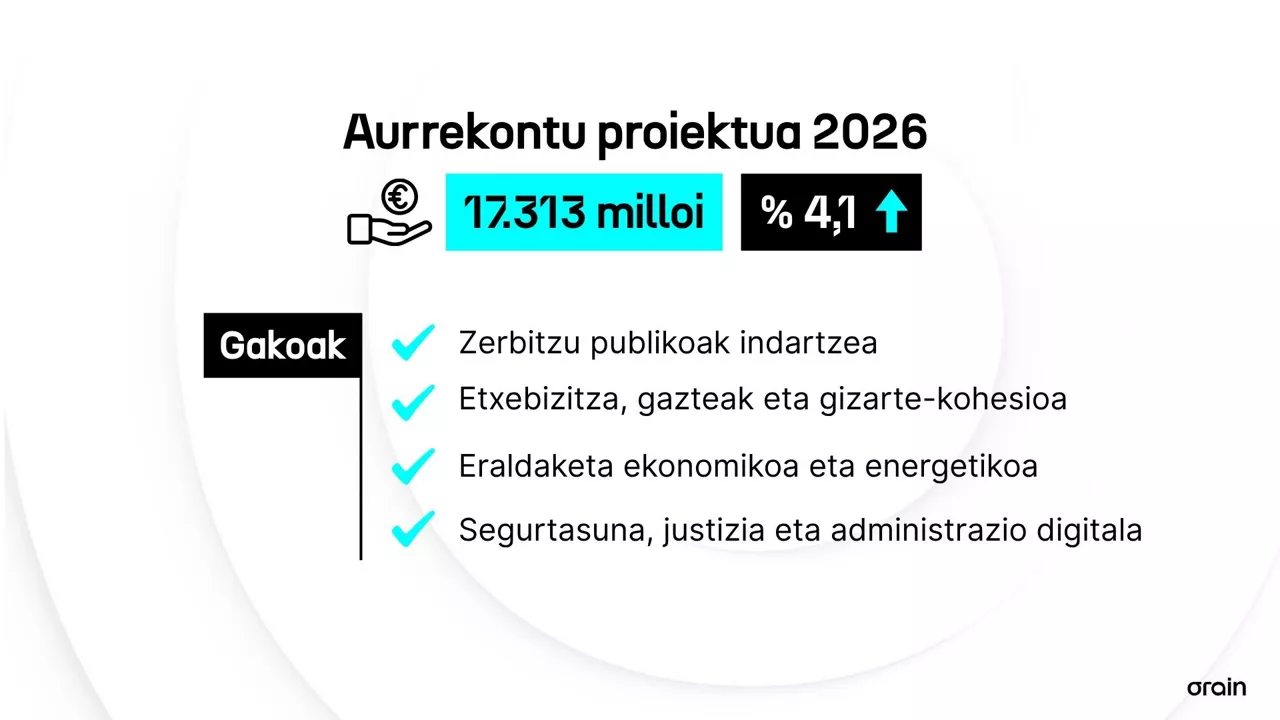

Nöel d'Anjou: "These budgets are a tool for transformation, protection and progress."

The Director of Finance points out that the draft budget presented today responds to three objectives: strengthening and consolidating public services, responding to citizens' concerns and preparing for future transformations and challenges.

The Basque Government approves a draft budget of 17 313 million by 2026, with more investment in housing and public services

The project increases current expenditure by 4.1 per cent and strengthens the areas of Health, Education, Housing and Security, in addition to increasing 935 million for the transformation plan "Transforming the Basque Country 2030". The Government allocates 1,801 million to young people and families and raises its own public investment to 1,730 million.

Amazon will lay off 30,000 workers from this Tuesday

In the last three years, the multinational has been progressively destroying about 27,000 jobs.

The Basque Government will present its draft budget for 2026 today

The Government spokesman has advanced that "there will be an increase in investments and items of interest and concern to the public".

Bizkaia self-schools will strike on 4 and 5 November

ELA and CCOO have announced a call to show their rejection of the "employers" bloc "in the negotiation of the agreement.